5G minnow is no Dealmaker.

Calnex Solutions Plc.

When I take a negative stance on a stock I remind myself of Morgan Housel’s excellent article “The Seduction of Pessimism”[1]. Housel makes the point that a cynical view is often formed from poorly thought-out extrapolations of the past, rather than actual critical thinking, that fails to recognise the adaptive systems around us. I constantly find myself wondering ‘Am I being critical to sound intelligent?’ Or ‘Am I illuminating areas worthy of further discussion?’ There is a fine line and I don’t always get it right.

Two main groups engage with my investment writing; fellow cynics and victims of schadenfreude or perma-bulls who protect their stocks like their own flesh and blood. My blog is intended to fuel measured debate between these two extreme perspectives and provide an alternative to the swamp of promotional corporate cheerleaders.

That said, engaging with people who disagree with me is far more rewarding. I've gained a lot from being open and willing to accept I might be wrong. Whichever side of the debate you fall, it pays to make it your business to understand the counter-thesis.

Now, let’s discuss Calnex Solutions Plc.

Compounder in the making?

Light-touch diligence convinced me that Calnex Solutions Plc (AIM:CLX) had the make-up of a long-term ‘compounder’. It ticked all the boxes:

Gravity defying return-on-invested-capital (ROIC)

Owner operator

Long runway for growth

High operating margins

Powerful and proven IP

High operating leverage

I think I’ll be forgiven for overlooking a punchy valuation with fundamentals like this, but elementary sleuthing disproved two crucial elements of my original thesis:

Acquisitions have performed poorly

Scaling manufacturing could prove complex and expensive

In this post I will cover why I couldn’t ignore these issues and what I found trawling through company filings and speaking with the company and suppliers. For now, Calnex will remain on my watch list.

Company background

Calnex creates hardware and software that the worlds leading Telecoms network operators trust to validate the performance of critical network infrastructure[2]. Calnex’s testing and measurement equipment has achieved unanimous ubiquity among testing engineers as the industry gold standard, to the extent that experience using the Paragon equipment series is a regular prerequisite quoted in job specs[3][4].

Industry background

The mass roll-out of 5G networks offers Calnex a major opportunity to grow at a clip. I don’t cover this side of the narrative, but I recommend the Cenkos ‘Initiation’ note if you wish to explore this further[5]. It is outstanding and does a far better job than I could of summarising the opportunity ahead of Calnex.

Acquisitions

Whenever a company makes a claim in an IPO prospectus I always check for evidence. The prospectus homed in on ‘experience in bolt-on M&A’:

The frequency of bolt-on acquisitions is expected to rise as this is now a key part of Calnex’s three-pronged growth strategy, number three being:

Calnex has executed two acquisitions in the last five years, let’s look at how they have panned out and test the credibility of these claims.

JAR Technologies

Calnex acquired JAR Technologies on March 26, 2018 and the IPO prospectus portrayed this as a bargain purchase[8], which arises when you buy a company at a price below fair market value and produces negative goodwill – good deal right? Not so fast. When it comes to glossy prospectuses, be sure to test for ‘IFRS’ and other historical adjustments that right the wrongs of the past. Let’s compare the IPO prospectus to the historical statutory accounts. The prospectus suggests Calnex acquired JAR for £96.4k settled through shares.

But the selling shareholders of JAR on the register at IPO sold c.2.6m shares worth £1.24m[9], did the value of Calnex really appreciate 13x in the space of two years?

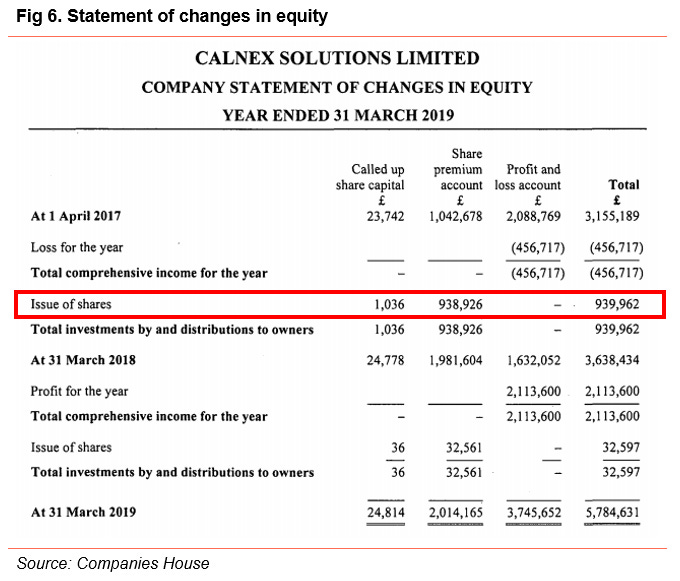

Calnex’s accounts pre-IPO reveal that the original treatment of this transaction was somewhat different. The amount paid per share was £90.80 for 10,352 ordinary shares[10], a total consideration of £940k roughly 4% of the entire share capital of Calnex, valuing Calnex at roughly £23.5m.

The cash flow statement shows an investing outflow of £1.25m[11] and financing inflow of £0.9m reflected in the rise in share premium[12].

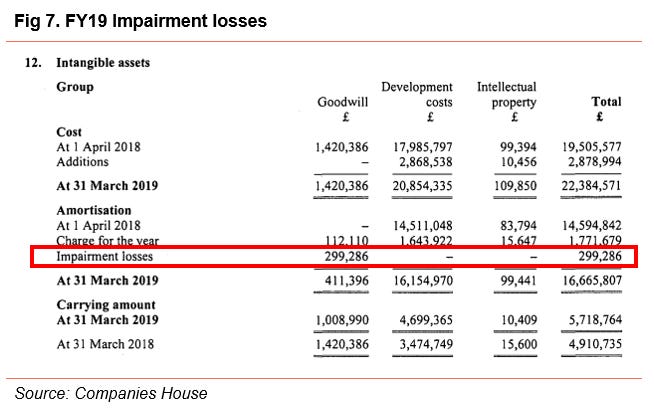

Why does all this matter? Well, this conceals impairment losses booked against this investment. In 2019[13] and 2020[14] combined, Calnex recognised a total impairment of £847k, which is close to 70% of the original investment – something I wouldn’t expect to encounter when a business is touted as an astute acquirer. This also understates the reinvestment necessary to grow. Cash or non-cash, equity funded M&A has a cost investors need to be aware of.

After reaching out to the CEO and the CFO, I was directed to the firm’s financial PR agency, Alma PR, who claimed the adjustments were due to a fair value exercise and to ‘reflect the non-cash nature of the transaction…’. Failing to address my question.

I reiterated my concerns. Alma PR eventually came back to me and advised they performed a detailed valuation exercise to recalculate the components of the JAR deal (which was over two years ago at this point) and adjusted the consideration paid to represent the value of Calnex at the time. Alma PR said this was due to the illiquidity of Calnex as a private firm but implies that Calnex was almost worthless when it bought JAR – would the selling shareholders accept worthless Calnex paper? I doubt it.

The prospectus changed the original consideration by undervaluing Calnex to create a ‘bargain-purchase’ and conceal impairment. In English, it appears that they’ve changed the figures because they didn’t like how they appeared to investors. OK, I might be over-emphasising this point but in future Calnex and RSM won’t have the ability to rewrite the past in any which way they please.

Speaking broadly, the IPO prospectus is another creative outlet for accountants and advisors to paint a picture of the past that suits their choosing. In my view, it boils down to how the taxman treats a given transaction. In this case, the restated historical financial information carries no weight with the taxman and the price paid back in 2018 forms the basis of the selling shareholders taxable capital gains. Accountants need to their feet held to the fire to produce information that favours economic reality over artistic interpretation. It makes you wonder if the FCA even read this prospectus in any detail before approving it.

Luceo Technologies

Calnex acquired the trade and assets of Luceo Technologies GmbH[15] on May 6, 2019 for a negligible value but less than seven months after acquisition it liquidated the operating entities, writing off cost of over £500k[16].

It gets stranger. Calnex Solutions (Berlin) GmbH was incorporated just four months before the liquidation on August 15, 2019. Germany is a tough place to start a business, ranked 122 out of 190 by the World Bank[17]. Alma PR shrugged off my concerns “…this was not a complex process, completed over 2-3 weeks with little effort…”. Things must have gone very wrong, very quickly to liquidate the business after just four months of setting up shop in Germany.

Summary

The IPO prospectus claims:

The reality:

JAR Technologies investment 70% impaired and misrepresented in the IPO prospectus.

Luceo Technologies dissolved, and investment written off in the same year.

It is difficult to validate if acquisitions have complemented the existing hardware or software offering but the fact that the investments have been impaired or written-off suggests the deals didn’t go to plan. Calnex’s own strategy is banking on successful M&A but there is no evidence that management have been able to execute at a very small scale.

Manufacturing scalability

Outsourcing manufacturing has helped Calnex consistently achieve gross margins above 75 percent. Kelvinside Electronics is the sole manufacturing partner who buy and assemble the parts for Calnex’s measurement and testing equipment. Anyone familiar with the Fever Tree growth story will be salivating at combination of high operating leverage and a runway for growth to turbocharge returns. The concern for me is that highly complex testing equipment is unlikely to scale as seamlessly as tonic production and bottling. Calnex accounts for at least 20% of Kelvinside’s business[18] and reliance on one manufacturer who operates from a single 40,000 Sq ft facility is not ideal.

This creates a difficult dynamic. If Calnex continues to grow at what point will Kelvinside Electronics need to increase capacity or shed customers? Both outcomes present a problem for Calnex:

1) An increase in capacity to produce Calnex’s niche equipment might cost more than it is worth to Kelvinside and need Calnex to share the costs of expansion.

2) Would it be sensible or Kelvinside to increase the concentration of its customer base? I’m guessing not at any cost and that the incremental costs will be borne by Calnex and rise in line with concentration risk.

This dynamic has worked while Calnex has operated as a sub £20m turnover business but I expect expansion to be more costly and complex over the next five years. Calnex has given little indication as to how it will address this.

Overdue Accounts

It didn’t sit well with me that Kelvinside is almost five months late filing its accounts for 2019[19], including the three-month COVID extension. Under normal circumstances Kelvinside is over eight months late! I discussed the issue with Kelvinside directly who told me that the audit had been held up due to the inability to perform a full audit remotely due to COVID restrictions.

When I asked Calnex the same question, Alma PR told me the issue was due to a shortage in staff and external audit pressure. I don’t doubt the credibility of the responses but audits have continued remotely and the labour market has remained fluid. I’m not comfortable the accounts are close to eight months overdue from the original filing date. The latest accounts available for Calnex’s sole manufacturing partner are almost two and a half years old. It’s important to understand if Kelvinside has grown its business alongside Calnex or if concentration risk has increased. This is impossible to tell right now.

Conclusion

Calnex occupies a highly profitable niche that will benefit from the structural growth driven by the 5G vision, but I need more evidence that this business can scale-up before I consider buying the stock. Acquisitive growth strategies carry major execution risk and if Calnex is to grow its earnings 3-5x in the next five to 10 years, I think material M&A will be needed. Calnex has delivered impressive organic growth during recent years. However, the performance of past deals and the manufacturing challenges ahead are too much for me to overlook at this stage. I will leave it with you to decide if I’m extrapolating pessimism or thinking critically.

All the best,

Dexter

Disclosure: I hold no position in Calnex (long or short).

[1] Morgan Housel, The Seduction of Pessimism, Collaborative Fund, June 13, 2017 (Link)

[2] Calnex Solutions Plc, IPO Prospectus, p. 7, Sep 21, 2020 (Link)

[3] Nokia, Precision Timing System Engineer (Link)

[4] Wipro, Datacom Testing-Architect (Link)

[5] Cenkos Securities Plc, Calnex Solutions Plc: Standing the test of time, Nov 4, 2020 (Link)

[6] Calnex Solutions Plc, IPO Prospectus, p. 8, Sep 21, 2020 (Link)

[7] Calnex Solutions Plc, IPO Prospectus, p. 23, Sep 21, 2020 (Link)

[8] Calnex Solutions Plc, IPO Prospectus, p. 72, Sep 21, 2020 (Link)

[9] Calnex Solutions Plc, IPO Prospectus, p. 94 - 95, Sep 21, 2020 (Link)

[10] Calnex Solutions Plc, Return of allotment of shares, March 26, 2018 (Link)

[11] Calnex Solutions Plc, Financial Statements, p. 15, March 31, 2019 (Link)

[12] Calnex Solutions Plc, Financial Statements, p. 14, March 31, 2019 (Link)

[13] Calnex Solutions Plc, Financial Statements, p. 22, March 31, 2019 (Link)

[14] Calnex Solutions Plc, Financial Statements, p. 25, March 31, 2020 (Link)

[15] Unternehmensregister, Calnex Solutions (Berlin) GmbH (Link)

[16] Calnex Solutions Plc, IPO Prospectus, p. 25, Sep 21, 2020 (Link)

[17] Ease of doing Business in Germany, The World Bank (Link)

[18] Calnex Solutions Plc, IPO Prospectus, p. 24, Sep 21, 2020 (Link)

[19] Kelvinside Electronics (Number 1) Limited, Companies House (Link)